-

Proverbs 16:3 Trading Strategy

Proverbs 16:3 Trading Strategy

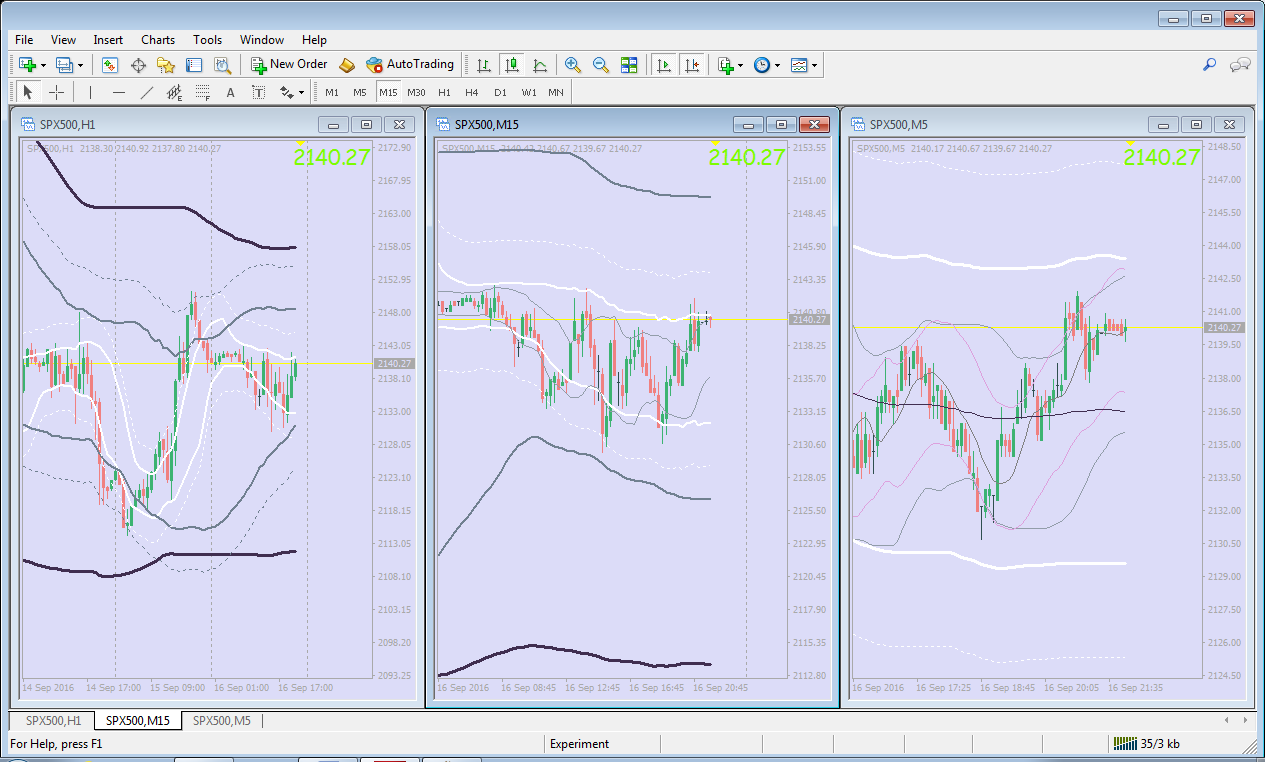

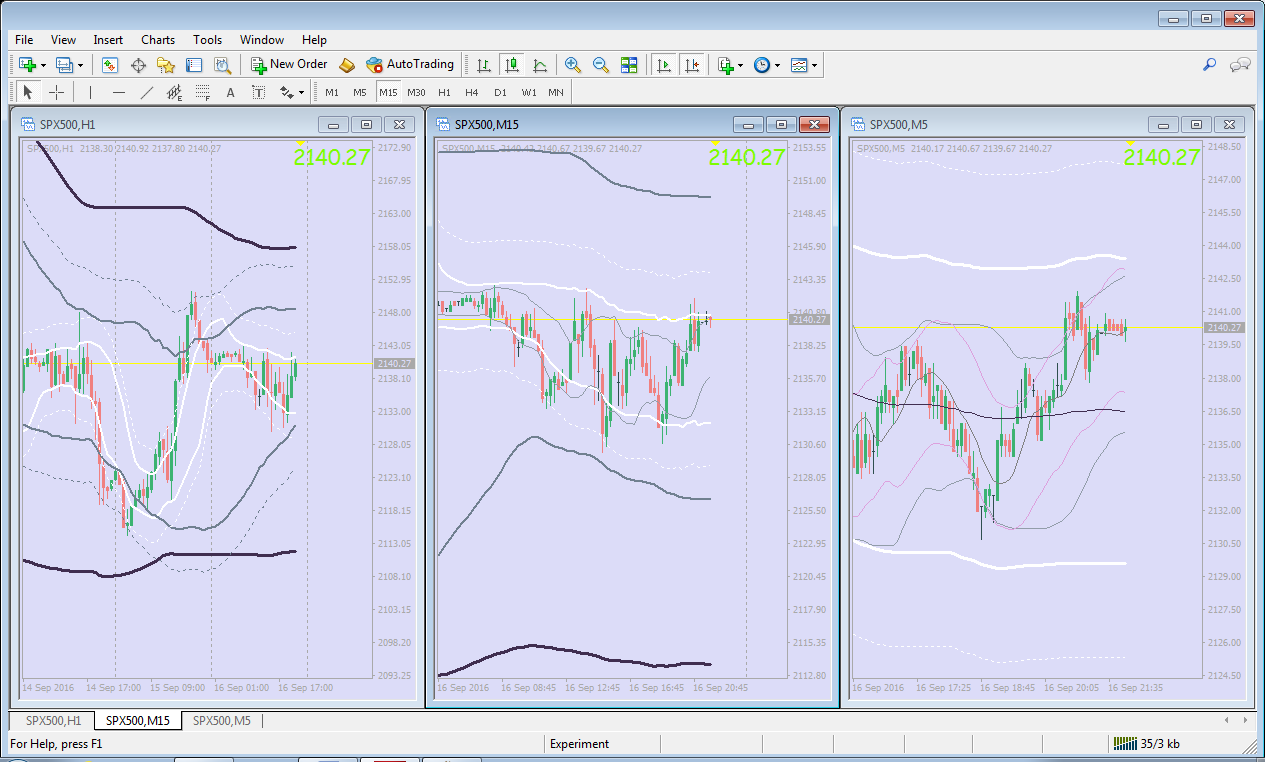

This day-trading strategy uses historical data to analyze price action based on relationships between the trend, designated sets of average price ranges and the overall 24-hour market structure across multiple time frames via "Dynamic Trailing Support and Resistance Envelopes" as pictured here:

I've looked around and it seems to me that the use of multiple envelopes, or "envelopes within envelopes" is somewhat of a hallmark for this approach in that I've yet to find evidence of it being used by anyone else who's been active online.

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules